CSV Management: Forging the Future on a Foundation of Trust

President and Chief Executive Officer

President and Chief Executive OfficerHiroaki Oda

Review of the Three-Year Period of the Medium-Term Management Plan

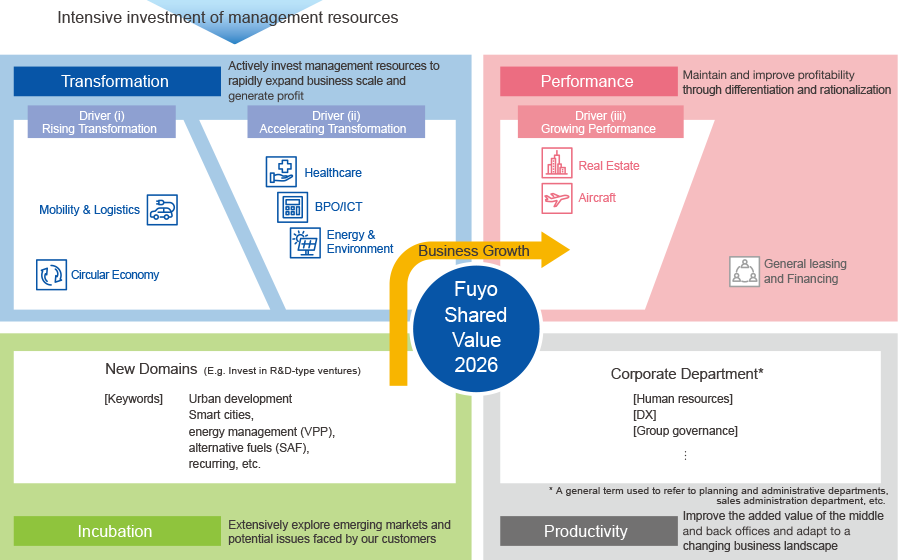

The Fuyo Lease Group has completed three years of its five-year Medium-Term Management Plan, Fuyo Shared Value 2026, initiated in fiscal 2022. Looking back, while we achieved our overall performance targets and attained a certain level of success, when viewed individually, some areas of the Transformation Zone's business domain are struggling to grow, and we are once again realizing the difficulty of growth. Looking back on the past three years, I believe we have just barely made it. Nonetheless, I sense that the Company’s distinctive value creation cycle is beginning to gain momentum, driven by our strong emphasis on building trust with customers along with our efforts to support the challenges and education of our employees.

Details on our respective business units classified in the Performance Zone are as follows. The Real Estate Business Unit, our core revenue driver, has maintained strong results in broadening its revenue streams across a range of assets that include offices, logistics facilities, hotels, and data centers. It takes a flexible approach to addressing regional changes in demand amid a favorable market environment underpinned by yen depreciation and sustained foreign investment.

The Aircraft Business Unit has achieved steady results with ordinary profit exceeding ¥10.0 billion in fiscal 2024. This was a result of it having focused on asset turnover-type business against a backdrop of a vibrant secondary aircraft market amid a business environment characterized by demand recovery and rapid growth coupled with constraints on the supply of new aircraft.

Under the medium-term management plan, we aim to move away from reliance on revenues from specific business units and transition to a “multiple peaks” (multiple growth engines) business revenue portfolio through diversification. Meanwhile, we have made significant progress in having begun to develop a business pillar beyond the Real Estate Business Unit, generating ordinary profit exceeding ¥10.0 billion.

While each business unit within the Transformation Zone has made steady progress, we have also identified challenges. By solving these issues, we seek to enhance the overall profitability and growth potential of our business portfolio.

The Energy & Environment Business Unit has more than doubled its operating asset base since the start of the medium-term management plan, achieving a steady growth. However, it will be some time before returns materialize given the existence of assets set to go into operation, primarily projects overseas. Although this constitutes upfront investment, we will take a forward-looking approach with ongoing investment, including that for overseas projects. Meanwhile, we are firmly committed to improving profitability through expansion of operating assets, which will involve establishing this business unit as one of our multiple peaks (multiple growth engine) revenue businesses that will enable sustainable growth.

In the Healthcare Business Unit, profitability has been bolstered by a situation where lending extended in response to the COVID-19 pandemic has entered into a recovery phase, which has prompted strong financing demand with respect to factoring for medical and nursing care receivables, resulting in substantial growth in outstanding balances. We have also made CB Holdings Inc., which provides medical consulting and M&A mediation, part of the Group. This enables us to establish a framework that extends beyond finance to also include upstream domains such as consulting and M&A mediation, while also broadening our revenue streams by focusing on both asset and non-asset businesses.

Although the BPO Business Unit and ICT Business Unit operate in areas still delivering robust customer demand, profitability has stagnated due to surging personnel expenses and challenges in securing human resources. We aim to achieve sustainable growth in these businesses by implementing bold cost structure reforms and actively participating in the data center business, currently gaining attention.

With regard to non-financial targets, the “contribution to CO2 reduction,” “amount of funds invested in promoting decarbonization,” and “reduction in customer workload” set in the areas of ‘environment’ and “society and people” are progressing smoothly, supported by strong operating results in each division.

Overview of Zone Management

Review of the Remaining Two Years and Future Strategic Areas

Next, I will outline the key points of our strategy for the remaining two years based on achievements of the past three years.

The overall financial targets remain unchanged at their initial levels.

Given the recent policy rate hike and other changes in the financial environment, we have slightly lowered goals for business domains where the impact of rising interest rates is unavoidable. On the other hand, we have raised goals for domains performing well with a continued emphasis on their growth. This has enabled us to establish an overall plan that is balanced, realistic, and ambitious.

With our non-financial targets, we have already exceeded objectives of the plan in some areas, and will continue to steadily build on these achievements going forward. Regarding electric vehicles, adoption domestically in Japan has not progressed as initially expected, which we acknowledge was an error in our projections. However, we will review our goals and work toward raising the proportion of EVs within our fleet over the next two years. To such ends, we have incorporated YAMATO LEASE CO., LTD., which operates currently active EV truck business, into the scope of our non-financial targets and are intensifying efforts to build up new business.

Financial Targets

|

Item |

Result |

Target |

|---|---|---|

|

Ordinary profit |

¥69.0 billion |

¥75.0 billion |

|

ROA |

2.3% |

2.5% |

|

Shareholders’ equity ratio |

13.3% |

13–15% |

|

ROE |

10.0% |

10.0% or more |

Non-financial Targets (excerpts)

-

*1Applies to investments and project financing, etc., made in the Renewable Energy Generation Business (power generation capacity is calculated based on ownership ratio or share).

-

*2Percentage at Fuyo Auto Lease and YAMATO LEASE

-

*3From returned items

-

*4Creating new value creation time through BPO/ICT services

In terms of business strategy, we are actively taking on challenges in new business domains to expand our scope of operations, with the aim of achieving sustainable growth and enhancing corporate value over the medium to long term.

In the Mobility Business Unit and Logistics Business Unit, we have positioned the Logistics Business Unit as a distinct domain and are accelerating full-scale entry into this field. We have made pallet rental business operator Wako Pallet Co., Ltd. a subsidiary and Japan Pallet Rental Corporation (JPR) an equity-method affiliate, thereby establishing a structure that enables us to engage in the entire logistics process beyond our warehouse-centered business thus far. We will address cross-functional challenges across logistics operations through direct involvement in onsite handling using pallets, wire cage carts, and other equipment.

We aim to contribute to the development of a circular society model by integrating the vast amount of data collected onsite with automation technologies in conveyance processes. With these new functions added to the Group, we will further contribute to solving customer issues across all stages of logistics, from upstream to downstream.

Another priority is accelerating new business creation in the incubation domain. In the carbon credit business, we are gaining deeper knowledge through our participation in a North American forestry fund and rice paddy projects in the Philippines. While this business area involves complex bilateral agreements and technical evaluation methods, it is also a sector that is steadily growing. Through collaboration with partner companies, agricultural organizations, and governments, we aim to supply carbon credits, which are key to balancing environmental and economic objectives. In the urban development business, we aim to provide multifaceted value that extends beyond real estate development to include community revitalization, energy, and mobility. Our initiatives through the Kobe Arena Project, which involve generating foot traffic in the community and creating new value in the surrounding area, exemplify the company’s strategic approach moving forward. Through these initiatives, we will create value that connects to the next generation by closely integrating the sustainable development of communities with Creating Shared Value (CSV) management. Looking ahead, we believe that global expansion is essential for the Group to achieve sustainable growth. Accordingly, we are currently conducting internal discussions in preparation for the next medium-term management plan, with the goal of stepping up our efforts. As we naturally intend to accumulate quality assets by focusing on selected businesses, we are currently doing our utmost to develop overseas personnel in preparation for this leap forward.

Advancing Value Creation Based on Customer Trust

The Fuyo Lease Group positions CSV at the core of its management and adopts a medium- to long-term growth strategy aimed at achieving sustainable corporate growth by solving social issues through its businesses. We believe it will be possible for us to realize CSV at a higher level by progressively solving social issues, through efforts that involve supporting the challenges and growth of each employee as outlined in our Vision, and having our employees engage in co-creation with our customers based on mutual trust. As illustrated in the diagram on p.2 of this report, our value creation story is grounded in continuous iterations of this cycle. Delving a little further into our CSV management approach, I see it as a process in which working closely with our customers brings about significant enhancement of their economic value and substantial progress in solving challenges of yet unseen issues, which in turn further increases the Company’s own economic value. I firmly believe that continually building customer trust and engaging in co-creation enables us to achieve greater corporate value and contribute to sustainable growth of society. All of our initiatives are built on a foundation of the trust placed in us by our customers, and this trust begins with people. As such, we strive to build close relationships with our customers, carefully listening to their challenges and needs. Through successive dialogue, we learn from our customers, reflect, refine our proposals, and deepen trust.

As this trust grows, we deliver proposals offering competitive advantages distinctive to the Group. We accordingly make every effort to ensure that customers choose our proposals for the value they embody in reflecting our expertise and knowledge. In so doing, we co-create value with our customers through an ongoing cycle of building trust, learning from proposals, and leveraging our competitive advantages. This serves as the key process in our value creation story. Our successive efforts in solving social issues through mutual trust and co-creation with our customers give rise to CSV at a higher level, thereby generating a virtuous cycle of sustainable social and corporate value.

Our trusting relationships with our partner companies are also critical. I believe that we can come up with even better solutions by forming alliances with partner companies and addressing challenges together with our customers. For this to succeed, our partner companies must perceive the helpful and valuable presence of the Fuyo Lease Group from the very beginning. As such, we aim to be recognized as a leading expert in our field while serving as a reliable partner that inspires collaboration and trust.

Supporting Challenges and Growth Toward Developing Trusted Professionals

Achieving value co-creation based on customer trust and sustaining growth hinges on the challenges and growth of each employee. As such, we actively invest in human resources across the entire Group to support the growth of our employees. At Fuyo General Lease, we set a non-financial target to increase human resource development-related expenses per employee by 300% over the duration of the medium-term management plan, and achieved the objective by the end of the previous fiscal year, two years ahead of schedule. During that time, we greatly enhanced our development programs and learning opportunities. In addition, we will actively facilitate employee assignment and secondment to specialized enterprises, including those overseas, particularly looking toward global expansion as we expand our business domains going forward. In so doing, we will strategically develop human resources capable of amassing expertise through on-site challenges and leveraging that experience to create new business domains. Moreover, we strive to create an environment where employees can assuredly take on challenges by fostering a corporate culture that values diverse opinions and prioritizes psychological safety. Employees perform at their best when supervisors listen attentively to each subordinate and value a stance of embracing new ideas. This constitutes a situation where true diversity is achieved, enabling such organizations to act flexibly in this era of volatility, uncertainty, complexity, and ambiguity (VUCA).

Reinforcing internal infrastructure and promoting digital transformation (DX) further strengthens the foundation for pursuing these challenges and growth. We create an environment that enables employees to better focus on meaningful dialogue and value creation by fundamentally reviewing and streamlining business processes while also adopting IT tools. In addition, we provide platforms for employees to cultivate their insights and ideas, which involves leveraging AI not only to streamline daily operations but also to act as a sounding board for supporting employee challenges and proposal activities. I am confident that these initiatives will create synergies among psychological safety, diversity, and digitalization, accelerating each employee’s growth and capacity to take on challenges.

In Conclusion

I believe our Integrated Report serves as a platform for us to communicate the Group’s story in terms of its path forward and progress made thus far, framed within a strategic perspective.

In doing so, I and the Company as a whole will uphold our duty of accountability while continuing to rigorously engage in CSV management practices together with our customers, shareholders, business partners, employees, communities, and future generations, with the aim of simultaneously delivering economic value to our customers and solutions to social issues. I recognize that management challenges of our customers are inevitably intertwined with social issues, and believe that engaging in co-creation with our customers leads to resolution of such social issues. As the Confucian philosopher Mencius observed, “Never has there been one possessed of complete sincerity, who did not move others.” In the same spirit, we strive to earn the trust of our customers through sincere dialogue and to create value together with them.