AT: Accelerating Transformation

Accelerated growth enabled by capturing market trends

*Affiliations and titles as of August 2025

*Affiliations and titles as of August 2025

Main Services

-

Business process consulting

-

Comprehensive BPO services

-

Integrated billing services (telecommunications and public utility bills)

-

Video production and distribution services

-

PC-LCM services

-

ICT outsourcing

Strong Point

-

Consistently provides a vast array of BPO services tailored to a variety of corporate issues grounded in business process visualization and consulting

-

Provides comprehensive solutions by integrating DX/SI with BPO services enlisting Group company collaboration

-

Provides a well-developed service menu to address various outsourcing needs, with ownership of approximately 1.80 million PCs Group-wide

Plans under Fuyo Shared Value 2026 and Vision for 2030

Vision for 2030

-

Serve as a company that provides business process services (BPS) encompassing total solutions utilizing outsourcing and DX of processes

-

Serve as the most trusted company in solving the problem of shortages of IT professionals

-

Serve as a company that contributes to expansion of digital infrastructure centered on data centers

Plans under Fuyo Shared Value 2026

-

1.Successfully reduce the workload of customers (save customers 1 million work hours compared to fiscal 2021) by providing BPO services and facilitating DX, thereby increasing productivity.

-

2.Establish a framework to provide Business Process Service (BPS) by strengthening links between BPO and DX-related consulting and various BPO services.

-

3.Support customers' business transformations by releasing valuable corporate IT professionals from non-core operations and putting them in high-value-added work through IT system operations outsourcing and facilitating DX

Fuyo Shared Value 2026 First Half Results

-

The pace of profit growth underperformed initial assumptions due to heightened human resource mobility and soaring personnel expenses, despite strong customer demand caused by labor shortages and other such factors

-

Enhanced service platforms through collaboration with alliance partners and expanded scope of operations particularly in the data center business

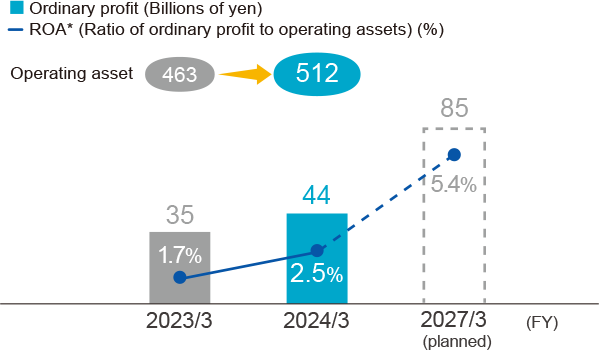

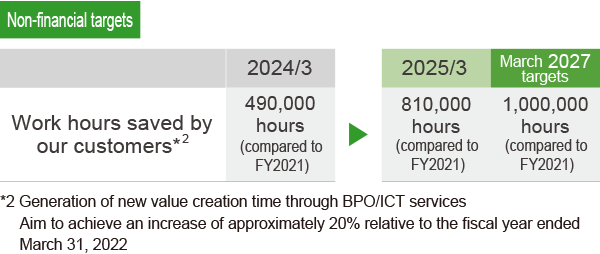

Financial targets

Non-financial targets

Issues Ahead and Response Measures

|

Issues Ahead |

Response Measures |

|---|---|

|

Develop services to address BPO needs that have emerged in the digitalization process |

Propose new ways to streamline operations through the use of AI and data |

|

Develop innovative services to respond to dramatic advances in AI technology |

Develop and offer services with partners that contribute to work efficiency |

TOPICS

1. Expand Service Lineup by Utilizing Group Functions and Partner Collaboration

The Group’s addition of BPO companies that provide various services has enabled us to pool each company’s specialized knowledge and expertise to establish a framework for comprehensively providing high-value-added services. Going forward, we aim to create new solutions through Group function reinforcement and partnerships, thereby helping to address corporate management challenges while facilitating sustainable growth of society as a whole.

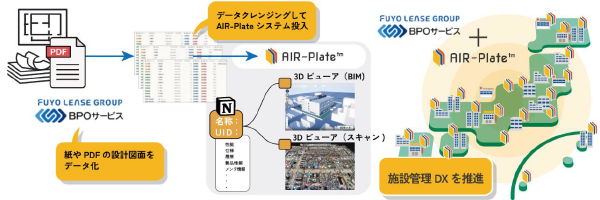

Conclusion of Business Agreement on the AIR-Plate Integrated Facility Management System

In August 2024, we concluded a business agreement with Azusa Research Institute Co., Ltd. regarding the AIR-Plate integrated facility management system. AIR-Plate is an integrated facility management system equipped with AI and BI, harnessing digital twin technology to promote digital transformation of facility operations. It serves as a groundbreaking platform solution that enables unlimited data storage. By combining BPO services with AIR-Plate, we aim to digitalize paper-based facility documentation and improve operational efficiency.

2. New Business Development Through Collaboration with Partners

As a result of combining its financing capabilities and various services in the ICT domain, the Fuyo Lease Group is able to offer products that help solve social issues related to shortages of IT professionals by improving operational efficiency associated with the in-house IT personnel of its customers. By leveraging Group company functions and collaborating with partners going forward, we aim to further enhance our products and expand the scope of our ICT services, thereby contributing to realization of a prosperous digital society while also solving corporate management challenges.

First Investment in a Development Portfolio Targeting U.S. Data Centers

In February 2025, we invested in a US data center development portfolio provided by Principal Real Estate Investors, LLC, the real estate investment arm of Principal Financial Group, Inc. (Iowa, USA; hereafter “Principal”). This project focuses on hyperscale data centers that are developed and invested in by Principal, and are either currently operational or scheduled to become operational. Looking ahead, we aim to make progress in gaining insights while further expanding our business domains amid projections of robust demand for construction of data centers that handle data processing, due to escalating use of cloud services and generative AI technologies.