GP: Growing Performance

Stable growth in core areas

*Affiliations and titles as of August 2025

*Affiliations and titles as of August 2025

Main Services

-

Real estate finance lease

-

Real estate operating lease

-

Real estate non-recourse loan

-

Real estate equity investment

-

Private REIT investment

Strong Point

-

Possesses trusted relationships and information pipelines developed through the accumulation of genuine and timely responses to sophisticated project consulting from the customer's viewpoint

-

Advanced operational skills and expertise in real estate leasing and finance built up by engaging in highly difficult projects head on over many years

-

Active in a vast array of business domains with highly specialized individuals at the industry's top level, obtained by expanding new areas and developing new schemes, with aspirations to attain differentiation and pioneer a blue ocean

Plans under Fuyo Shared Value 2026 and Vision for 2030

Vision for 2030

-

Expand and extend business domain in the real estate sector, taking on challenges of creating new value. Contribute to solving social issues

-

Provide optimal solutions as the ideal partner to customers while achieving sustainable growth together with customers

Plans under Fuyo Shared Value 2026

-

1.Promote priorities such as developing new products and services by conducting extensive collaboration with customer divisions and other dedicated divisions, with the goals of expanding business domains and developing new schemes.

-

2.Expand collaboration with partner companies through sales activities based on solution proposals, with a particular emphasis on promoting community contribution through partnerships with regional financial institutions and regional infrastructure companies.

-

3.Contribute to realizing a prosperous society by implementing CSV through such means as environmentally friendly real estate aimed at realizing a decarbonized society.

Fuyo Shared Value 2026 First Half Results

-

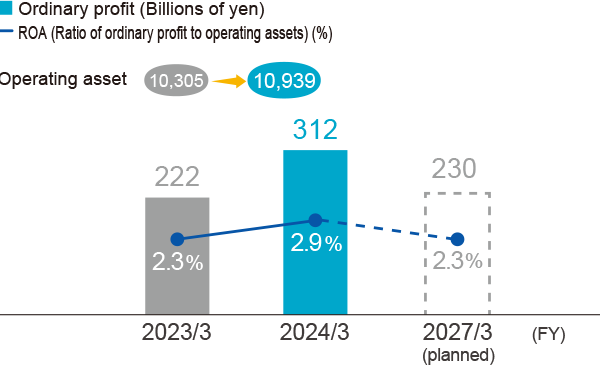

Achieved the ordinary profit target set when formulating the medium-term management plan ahead of schedule against the backdrop of quality asset accumulation and a strong market environment

-

Executed asset controls based on the composition of the business portfolio

-

Took a cautious approach to overseas real estate in carrying out initiatives cognizant of risk and return, premised on collaboration with alliance partners

Fiscal 2024 Results

-

Maintained asset controls based on profitability and the composition of the business portfolio

-

Achieved steady growth in ordinary profit, excluding the impact of gains on sales of large accounts

Financial targets

Issues Ahead and Response Measures

|

Issues Ahead |

Response Measures |

|---|---|

|

Enhancement of profitability in light of real estate market trends amid rising interest rates |

Continually monitor market conditions to identify and address subtle changes. |

|

Review of product mix in response to revisions in lease accounting standards |

Accurately identify customer issues and needs, then develop and provide services and solutions that meet those needs |

|

Acquisition and accumulation of expertise to address increasingly diverse property uses and schemes |

Collaborate with other domains according to use of each property, enlist external functions and personnel, and develop human resources through training programs |

TOPICS

1. New Initiatives to Create Environmental and Social Impact

In partnership with Sumitomo Forestry Co., Ltd., the first Japanese company to carry out office development using the wooden expansion and renovation approach in London, U.K., we participated in an initiative to substantially reduce CO2 emissions over the entire lifecycle of a steel-frame building in London by incorporating wooden extensions within the building’s existing structural interior. Through our participation in this initiative, we will work to promote more widespread adoption of environmentally friendly real estate.

2. Investment in the QOL Fund, Japan’s First Social Impact Real Estate Fund

We invested in a fund formed by PROFITZ Co. Ltd. and focused on improving Quality of Life (QOL). The fund encompasses four asset classes: childcare facilities, rental housing, shared offices, and hotels. We seek to enhance the overall value of real estate by contributing to the creation of social impact through initiatives that include establishing childcare facilities to help solve the issue of wait-listed children, and by participating in new initiatives that involve measuring such impacts.