RT: Rising Transformation

Strategic growth enabled capturing tectonic social changes

*Affiliations and titles as of August 2025

*Affiliations and titles as of August 2025

Main Services

Vehicles area

-

Auto leases

-

One-stop EV services

-

Self-driving vehicle services

-

EV bus subscription-based services

Logistics area

-

Logistics and material handling equipment financing services

-

Services for optimizing in-warehouse operations

Strong Point

-

Possesses a framework that can provide financing and related services for a broad range of vehicles from passenger cars to trucks, along with Group companies Fuyo Auto Lease Co., Ltd. and YAMATO LEASE CO., LTD.

-

Expanding to new domains such as EVs for commercial use, automotive batteries, and self-driving vehicles, through collaboration with partner companies.

-

Conducting business globally together with overseas Group companies centered on Pacific Rim Capital, Inc., which became a consolidated subsidiary.

-

Providing logistics standardization, automation, and labor-saving solutions, starting from logistics materials essential in logistics sites.

Plans under Fuyo Shared Value 2026 and Vision for 2030

Vision for 2030

-

A company that solves decarbonization and other social issues through social application of various technological innovations in the general vehicles area

-

A solution provider that works to solve issues such as personnel shortages and workstyle reforms together with Group companies and partner companies in Japan and overseas in the logistics area

Plans under Fuyo Shared Value 2026

-

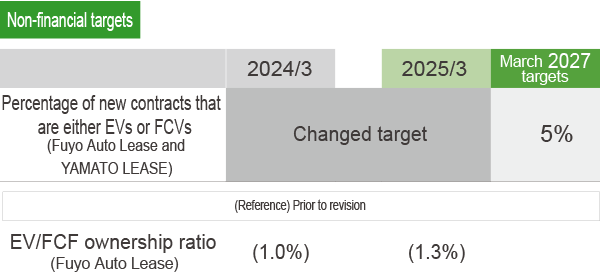

1.Aim for EVs and FCVs to account for 5% of new contracts at Fuyo Auto Lease and YAMATO LEASE through the provision of one-stop EV services and other means.

-

2.Promote total support for the logistics industry, which faces issues such as the 2024 problem, personnel short-ages, and cost increases, in collaboration with partner companies.

Fuyo Shared Value 2026 First Half Results

-

Enhanced domestic and overseas services including the EV Life Cycle Service and EV Fleet Management Service through collaboration with alliance partners

-

einforced overseas business by making Pacific Rim Capital (U.S.) and PLIC (Thailand) subsidiaries

-

Promoted inorganic strategies to further reinforce functions in the logistics area

-

WAKOPALLET Co., Ltd. made a consolidated subsidiary: March 2025

-

Japan Pallet Rental Corporation made an equity method affiliate: April 2025

Fiscal 2024 Results

Offset rising domestic procurement costs through strategic asset accumulation and performance growth at overseas subsidiaries to maintain overall performance levels

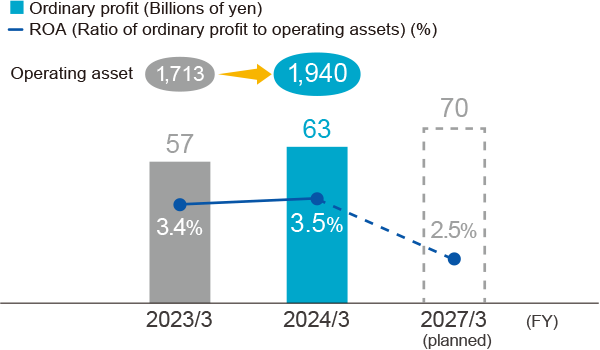

Financial targets

-

*1Simple sum of domestic subsidiaries (Fuyo Auto Lease/YAMATO LEASE)

Non-financial targets

-

*1Simple sum of domestic subsidiaries (Fuyo Auto Lease/YAMATO LEASE)

Issues Ahead and Response Measures

|

Issues Ahead |

Response Measures |

|---|---|

|

Increase in percentage of new contracts that are either EVs or FCVs |

Enhancement of EV-related services through collaboration with partner compa-nies, and fortified sales centered on one-stop services |

|

Expansion of business domains in logistics area (nontraditional financing) |

Identifying functional enhancement domains and assessing partner companies taking into account future logistics transformation |

TOPICS

1. Offering Decarbonization Solutions to Municipalities and Private Companies in Collaboration with the Kyuden EV Bus Service

We have launched the Kyuden EV Bus Service, a subscription-based service, through a collaboration with the Kyushu Electric Power Group and EV Motors Japan Co., Ltd. The EV buses being introduced can be used (through sharing) for multiple purposes, including as school buses, shuttle buses, and sightseeing buses. The vehicles' rechargeable battery functions can be used to set up local disaster preparedness centers and reduce electricity consumption at facilities during peak hours. This in turn will advance local decarbonization efforts and promote the shift to EVs among municipalities and private companies. The first commercial project has now started on Okinoerabu Island, Kagoshima Prefecture.

2. Expanding Services to Encourage Adoption of EVs for Commercial Use Through Collaboration with Partner Companies

Because the spread of EVs in the logistics industry is limited to low-priced EV vehicle models suited to use in long-distance transport, and because of a shortage of charging infrastructure, there is a lack of specialized knowledge of maintenance and other issues. To solve these issues, we are accelerating our collaboration with partner companies to expand our lineup of services designed to encourage the adoption of EVs for commercial use. We have entered into a capital and business alliance with Folofly Inc., which is engaged in the development and sales of EVs for commercial use, and are working to develop vehicles and services that meet the needs of the logistics industry. In addition, through a collaboration with EVolity Corporation, which offers fleet management services for commercial use EVs, we are building a cooperative structure that can provide one-stop support for everything from initial deployment to vehicle management.

3. Logistics Solutions Business Division Launched to Strengthen Ability to Solve Logistics Industry Issues

To strengthen our efforts to solve issues surrounding the logistics industry, including the 2024 problem and personnel shortages, we have renamed the Machinery Business Division to the Logistics Solution Business Division, reorganizing it with a specialized role in logistics.

We also entered into a capital and business alliance with PAL Co., Ltd. which is working to promote DX on the front lines of logistics, and are advancing cooperation with partner companies to expand and build a structure for services by, among other things, creating diverse financing schemes to support the capital investments needed for automation and labor savings.