| Name | Fuyo General Lease Co., Ltd. No.31 unsecured corporate bonds (limited to corporate bonds with a special agreement on the same priority) (Sustainability Bond) (known as "Fuyo CSV Bond") |

|---|---|

| Issue duration | 5 years |

| Issuance amount | 10 billion yen |

| Coupon rate | 0.120% |

| Condition decision date | September 10, 2021 |

| Issue date | September 17, 2021 |

| Redemption date | September 17, 2026 |

| Use of proceeds | Refinance of the following in Use of Proceeds for this Sustainability Bond |

| Ratings | Japan Credit Rating Agency, Ltd. (JCR): A+ Rating and Investment Information, Inc. (R&I): A |

Third-party Assessment of Eligibility

JCR Sustainability Bond Rating

This sustainability bond has been externally evaluated by the Japan Credit Rating Agency (JCR) regarding its conformance with the Green Bond Principles 2021, the Social Bond Principles 2021, and the Sustainability Bond Guidelines 2021 of the International Capital Market Association (ICMA) and the Green Bond Guidelines 2020 of the Ministry of the Environment.

Use of Proceeds for this Sustainability Bond

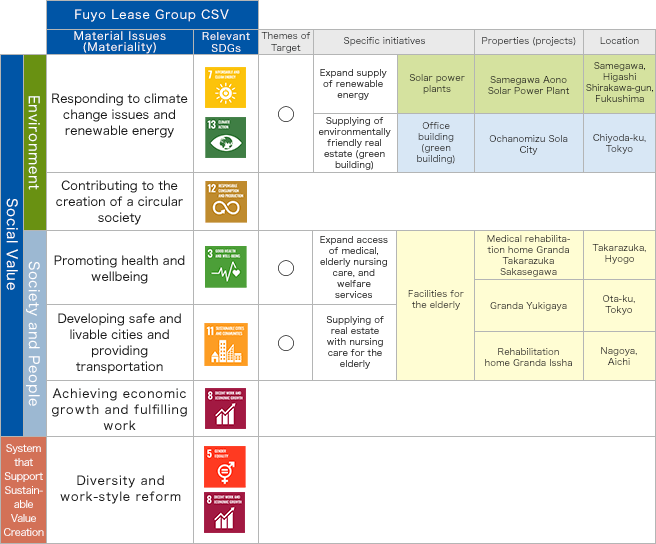

This sustainability bond ("Fuyo CSV Bond") is intended to refinance the following green projects and social projects among the important initiatives related to the Group's CSV.

-

(News release as of August 20, 2021: Issued Sustainability Bond (Fuyo CSV Bond))

Announcement of Investment in the Sustainability Bond

These are the investors who have announced that they will invest in the Sustainability Bond.

List of investors who have announced investment (Japanese alphabetic order)

(As of September 10, 2021)

-

Asset Management One Co., Ltd.

-

Izawa Metal Co., Ltd.

-

The 77 Bank, Ltd.

-

Jodo Shu

-

Tokio Marine Asset Management Co., Ltd.

-

The Toa Reinsurance Company, Limited

-

Nissay Asset Management Corporation

-

Higashi-Nippon Bank, Ltd.

-

Mitsui Sumitomo Insurance Company, Limited

-

Sumitomo Mitsui DS Asset Management Company, Limited

-

Sumitomo Mitsui Trust Asset Management Co., Ltd.

-

Mitsubishi UFJ Trust and Banking Corporation

Reporting

Scheduled to be updated after fund allocation