AT: Accelerating Transformation

Accelerated growth enabled by capturing market trends

*Affiliations and titles as of August 2025

*Affiliations and titles as of August 2025

Main Services

-

Various types of financing for healthcare assets

-

Factoring of medical and nursing care receivables

-

Consulting, M&A mediation, and BPO services for healthcare providers

-

Business succession and turnaround financing

-

Purchase and disposal of used medical equipment

-

Energy conservation and energy services business for medical institutions

Strong Point

-

Expansive menu of services, including healthcare business facility initiatives, business succession and turnaround financing, and factoring of medical and nursing care receivables

-

Business process consulting, BPO services, digital transformation (DX), and circular economy functions that help enhance the management efficiency of medical and nursing care providers

-

Management support services of CB Holdings through management consulting and M&A mediation tailored to the medical, nursing care, and welfare industries

Plans under Fuyo Shared Value 2026 and Vision for 2030

Vision for 2030

-

A company that contributes to improvement in the quality of medical and nursing care in Japan by helping to maximize the value of management resources (people, tangible assets, funds, time, information) held by medical and nursing care providers and dispensing pharmacies

-

A company that realizes both the solution of medical and nursing care issues (non-financial value) and profit growth that capitalizes on market trends (financial value) at a high level

Plans under Fuyo Shared Value 2026

-

1.Support the creation of 1,330 new rooms at elderly care homes over a 5-year period in collaboration with alliance partners, in anticipation of the super-aging of society

-

2.Implement digital transformation (DX) in medical and nursing care by providing solutions in collaboration with Group companies and alliance partners to address management issues for each development stage of medical and nursing care businesses

-

3.Intensively invest management resources in business domains expected to see strong demand, including business succession and turnaround financing, initiatives related to healthcare facilities, factoring of medical and nursing care receivables, and management support for succession.

Fuyo Shared Value 2026 First Half Results

-

Revenue growth has been slow as financing needs of medical institutions declined accompanying public support from the Welfare and Medical Service Agency (WAM) during the COVID-19 pandemic from when the mediumterm management plan was initiated in 2021 through 2023

-

However, we have substantially expanded our business domain through the formation of region-specific healthcare funds (with 77 Bank in the Tohoku region and Higo Bank in the Kyushu region) and initiatives involving new healthcare business facilities, such as hospices

Fiscal 2024 Results

-

Asset balances increased from the second half of the fiscal year, primarily driven by factoring of medical and nursing care receivables

-

CB Holdings became a consolidated subsidiary and serves as a key company in the non-financing domain

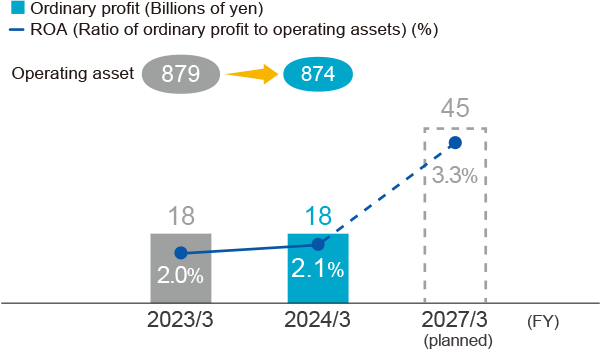

Financial targets

Non-financial targets

Issues Ahead and Response Measures

|

Issues Ahead |

Response Measures |

|---|---|

|

Support for medical and nursing care providers subject to deteriorating management environments |

Provide finance functions as well as non-finance functions through consulting and other such services |

|

Address the permanent shortage of personnel among medical and nursing care providers |

Bolster personnel in BPO services and advance the shift to DX |

|

Substantial succession needs among successors in medical institutions |

Provide management and succession solution functions enlisting substantial specialized knowledge |

TOPICS

1. Supporting Development of a Next-Generation Nursing Care Business Model Through Finance, Offering Reassurance with Expansion of Regional Elderly Care Homes

Fuyo General Lease worked with a regional bank to support the development of private nursing homes, providing financial support for the expansion of regional elderly care.

This will work to address the severe shortage of personnel in the nursing care industry by achieving two things: (1) An improved quality of care through employment in a variety of professions, including physical and occupational therapists as well as care workers and nurses; and (2) Improved compensation for nursing care staff with additional incentive programs for the use of scheduled and as-needed home visit-based nursing care.

2. Use of Outsourcing Solves Issue of Securing Personnel in Conjunction with Business Growth

Accretive has launched full-scale BPO services, including insurance billing and other operations for home healthcare and nursing care providers. As demand for these care services increases with Japan's aging population, providers are facing a serious shortage of personnel. GRID Co.,Ltd. which for many years has provided in-home and other nursing care services in Kyoto, was also dealing with the issue of securing personnel in conjunction with an expansion of its business. Using our services, it was able to reduce the burden involved with billing operations, enabling the company to focus on services for its users.

3. Dismantling and Removal of High Energy Radiation (LINAC) and Other Treatment Devices Makes Recycling Possible

FUJITA conducts dismantling and removal of linear accelerators (LINACs), extremely heavy equipment the handling of which requires a high degree of skill. LINACs are installed in radiation controlled areas of acute care facilities, thus in addition to the technical aspects of dismantling the equipment, FUJITA takes steps to ensure the safety of the working environment, including by measuring radiation exposure. The medical facility will dispose of parts of the dismantled device as radioactive waste, as appropriate. The rest consists largely of scrap iron and other material and is sent for recycling, a contribution to realizing a circular society.