Our Approach to Risk Management and Risk Management System

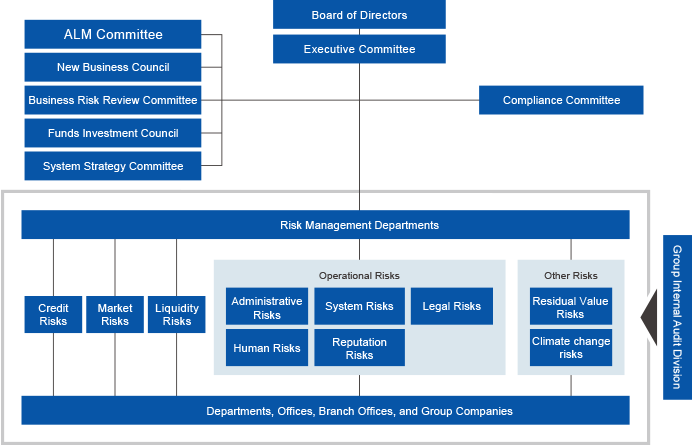

As stipulated in the Fuyo Lease Group risk management regulations, we have established a risk management system at our locations across the globe in order to manage risks based on their particular risk characteristics and importance.

Risks to be managed are categorized into credit, market (such as interest rate fluctuation risk), liquidity (such as cash flow risk), administrative, system, legal, human, reputation, and other risks. Each type of risk is managed by a designated department.

The Board of Directors and the Executive Committee receive updates on risk management, discuss risk management policies according to the characteristics and importance of each risk, and evaluate the effectiveness of risk management. The Asset and Liability Management (ALM) Committee meets on a regular basis to appropriately manage and control market and liquidity risks. These efforts enable us to establish an appropriate risk management approach, prevent the occurrence of risks, and minimize their impact when they do materialize.

For risk events that may affect the Group's business, the Group has sought to comprehensively identify risks facing each Group business considering the scale and characteristics of the identified risks while making sure to include risks in each business domain, such as economic downturns, market fluctuations, and downturns in individual markets.

We have established an overall risk management framework based on the Group's risk management regulations. When a material risk manifests, it is reported swiftly to the Corporate Planning Division, the organization in charge of risk management, which then gives appropriate directions concerning risk management to the relevant designated risk management divisions. Furthermore, the Corporate Planning Division compiles information on the risk management situations of the entire Group and the Director and Deputy President who acts as Risk Supervisor reports on each risk management situation to the Executive Committee, which is chaired by the President, and makes regular reports to the Board of Directors.

In addition, as a risk governance system for the entire group, we have established a "Three-Line Defense System" based on risk management by each business unit (first line), risk management by the risk control department and the department in charge of risk (second line), and verification by the internal audit department (third line).

The designated risk management division formulates a basic policy for managing risks identified as targets, and conducts an appropriate analysis, evaluation and measurement of risks according to the size and characteristics of the relevant business and risk profiles. In addition, the designated risk management division monitors the status of risks held from an independent perspective, reports the results of monitoring to the Executive Committee, etc., and implements supervision of sales and marketing divisions with an approach geared to the situation.

Risk Management System

Integrated Risk Management Structure / Key Risk Categories and Management Methods

The risk control division has established integrated risk management systems to promote risk management by comprehensively identifying and evaluating risks by risk category, and to control risks with the scope of management capabilities.

The Group has introduced risk capital management as a primary method of integrated risk management. Based on the amount of shareholders' equity, we control risk by determining the allocation of risk capital for each risk category, taking into account the risk status of our existing portfolio and our latest business strategies.

|

Risk category |

Risk definition |

Method of management |

||

|---|---|---|---|---|

|

Integrated risk management (risk capital allocation, quantitative assessments (VaR), scenario analysis, etc.) |

||||

|

Credit risks |

Risk of incurring losses due to a decline in the value of assets (including off-balance-sheet assets) caused by the deterioration of credit counterparties' financial conditions |

|

||

|

Market risks |

Risk of incurring losses due to fluctuations in the value of assets, liabilities, etc. caused by changes in market risk factors such as interest rates, exchange rates, stocks, bonds |

|

||

|

Liquidity risks |

Risk of incurring losses due to being forced to secure funds at exceedingly high interest rates, or facing difficulty in securing the necessary funds |

|

||

|

Asset risks |

Property price fluctuation risk |

Risk of significant fluctuations in the value of owned assets, such as aircraft or real estate, due to economic downturns, interest rate fluctuations or changes in business conditions, and the risk that the sale prices of various leased assets may fluctuate and fall below their residual value |

|

|

|

Residual value risks |

||||

|

Investment and financing risk |

Business risk |

Risk of not achieving the expected returns and a decline in the recoverability of investment amounts due to stagnant performance by investees or partners, and the risk of impairment losses on goodwill or other assets associated with M&A activity |

|

|

|

Goodwill impairment risk |

||||

|

Operational risks |

Administrative risks |

Risk of incurring losses or damages in the course of business due to internal management issues or external factors, and the risk of incurring losses due to a deterioration in reputation |

|

|

|

System risks |

||||

|

Legal risks |

||||

|

Human risks |

||||

|

Reputational risks |

||||

|

Others |

Risks related to the external environment |

Climate change risks and risks due to natural disasters, etc. |

|

|

Risks in Business Operations

Listed below are the main factors that could pose risks to the development of the Group's business and have a significant impact on the decisions of investors. The forward-looking statements here represent the judgment of the Group's management as of the date that its annual securities report was submitted (June 23, 2025). The following is not an exhaustive list of all the risks that could affect investment in the Company's shares.

|

Risk Factors in Business Development |

|

|---|---|

|

Risks relating to changes in capital expenditure trends and other factors |

Credit risks |

|

Risks relating to changes in factors such as interest rates, exchange rates, share prices and financing |

Risks relating to changes in regulatory systems |

|

Risks relating to strategic partnerships and corporate acquisitions |

Risks from natural disasters or other causes |

|

Risks relating to business strategies |

Risks relating to overall business operations |

|

Cyber security risks and information security risks |

Climate change risks |

|

Risks related to promoting digital transformation (DX) |

|

Response to Risks

The Fuyo Lease Group assumes various risks that may arise in the course of business development and is implementing measures to counter these risks. Details of the business risks for the Group are disclosed in our annual securities report, and major countermeasures are described below.

Risks Related to Information Security

With unauthorized access to information via the internet as well as cyber-attacks increasing daily and becoming more sophisticated, the Group recognizes that information security risks are an important management issue. In order to establish a strict information management system for the entire Group, data is strictly controlled by our information security manager in accordance with detailed rules, including the Confidential Information Management Rule. Additionally, each employee is thoroughly informed of the Management of Information Assets and Respect for Intellectual Property Rights section included in the Fuyo Lease Group Basic Compliance Policy as well as the Privacy Policy, and we have implemented level specific information security training programs.

In fiscal 2024, we conducted information security training led by external experts for directors, heads of departments and branch offices, and others. We also held training for 1st year generalist track employees.

Risks Related to Disasters, etc.

The Fuyo Lease Group has developed a system for responding to emergencies. In the event of a large-scale disaster or emergency, the emergency response task force under the direction of the President will take measures necessary for ensuring safety and the continuity of our operations in accordance with the BCP Fundamental Principle and the Emergency Preparedness Regulations. We conduct regular drills to minimize damage and ensure business continuity. Following the relocation of our headquarters, we standardized disaster stockpiles across all Group companies and identified the highest priority business operations for continuity within our Group companies. Additionally, we have also built a Group-wide collaboration system for disaster response, which includes a liaison meeting held four times a year to share information with the persons in charge of disaster prevention at our Group companies.

In response to the spread of COVID-19, the Group established the COVID-19 Emergency Response Task Force under the direction of the President in April 2020. We ensured that all employees and directors understood and adhered to infection prevention measures, such as mobile working, working from home, flexible working hours, and reducing overtime, while also reporting to the Board of Directors and the Executive Committee on any impacts on business performance. The COVID-19 Emergency Response Task Force was disbanded as of May 8, 2023, and the records of its activities and other information were reported to the Board of Directors.

Based on these experiences, since fiscal 2023, we have been reviewing and improving measures based on specific disaster scenarios, such as a major earthquake directly beneath the Tokyo metropolitan area or a Nankai Trough earthquake, and working to strengthen collaboration among our Group companies, aiming to improve our Business Continuity Plan (BCP) to be more practical. Specifically, these include ensuring communication means during a major disaster; detailing procedures for setting up an Emergency Response Task Force; creating a Q&A to guide employee actions in the event of a major disaster; securing power supplies and emergency stockpiles; and enhancing the quality of BCP drills across the entire Group.

Risk Management Training

In order to foster a corporate culture that enables risk prevention and that can take appropriate measures against risks, the Fuyo Lease Group regularly conducts training that includes content related to risk management. For example, in the leasing industry, legal risks are expected to be high, so training is conducted for new employees on regulatory laws and regulations. We focus on training using case studies and other methods so that each employee can deepen their understanding of possible risks in their work and take appropriate measures.

Our Approach to Compliance and Compliance System

At the Fuyo Lease Group, ensuring compliance is a fundamental principle of management. We work to strengthen and enhance our compliance system, which enables us to operate with integrity and fairness by not violating social norms, while strictly complying with all laws and regulations.

We promote compliance throughout the Group by stipulating various regulations, procedures, and manuals, conducting compliance education, and enhancing the whistleblowing system on the basis of the Fuyo Lease Group Basic Compliance Policy. In order to maintain and further improve our compliance systems, we implement and carry out compliance programs every fiscal year. Compliance programs are discussed at the Compliance Committee, which is chaired by the Director and Deputy President who acts as Compliance Supervisor, and the Executive Committee, before being approved by the Board of Directors. Progress on activities is reported to the Board of Directors on a semi-annual basis and Directors provide supervision on the promotion of compliance.

The Compliance Committee, which is central to the Group's compliance framework, is chaired by the Director and Deputy President who acts as Compliance Supervisor of Fuyo General Lease, and also comprises the officer in charge of the Group Legal & Compliance Division as vice-chair, the heads of planning and management divisions and divisions overseeing domestic and overseas subsidiaries as regular committee members, and an external attorney-at-law as an outside committee member. To verify the effectiveness of the compliance system for the entire group, the Compliance Committee meets every three months to deliberate and report on the formulation and progress of the Group's compliance program, whether or not compliance problems have occurred and how to deal with them, and trends in the enactment, revision, or abolition of major laws and regulations. In addition, the Group Internal Audit Division conducts an annual audit covering matters such as compliance with laws and regulations as stated in the Fuyo Lease Group Basic Compliance Policy, as well as the situation in regard to conducting fair business activities, risk management, and the management of information assets. The results are used in considerations for improving initiatives to further strengthen the compliance framework.

We will continue our group-wide activities including management and implementation of compliance measures and compliance education, and streamlining our compliance systems across the Group to improve their effectiveness.

Fuyo Lease Group Basic Compliance Policy

The Fuyo Lease Group has formulated the Fuyo Lease Group Basic Compliance Policy, which specifies the basic policies and position of the entire group as well as behavioral guidelines for the employees of the Group.

We conduct training programs and offer e-learning courses to all employees to enhance the effectiveness of the Basic Policy. These programs and courses ensure that all employees are aware of the Basic Compliance Policy, and evaluation of the training is regularly reviewed.

Fuyo Lease Group bases its business management on the approach of CSV (Creating Shared Value), and aims for building a sustainable society and at the same time achieving the Group's continuous growth through its business undertakings.

For realization of these aims, it is essential to engage in compliant practices supporting sound corporate management with our mission, vision and values. Fuyo Lease Group has established this Fuyo Lease Group Basic Compliance Policy as guidelines for conduct to be observed by its directors, officers and employees.

1. Compliance with Laws and Rules

-

(1)Fuyo Lease Group regards compliance as one of the most important management issues, will strictly comply with all laws and rules, and will engage in business honestly and fairly, without deviation from social norms.

-

(2)Fuyo Lease Group will not only comply with international rules and the local laws of countries and regions in which Fuyo Lease Group conducts business, but will also respect the customs and cultures of such countries and regions.

2. Respect for Human Rights

Recognizing the risk that Fuyo Lease Group's business activities may have an adverse effect on human rights, Fuyo Lease Group will, through its business activities and in accordance with the Fuyo Lease Group Human Rights Policy, contribute to the realization of a society in which human rights are respected.

3. Commitment to Environmental Issues

Recognizing that environmental issues are not only community issues but also global issues, Fuyo Lease Group will be actively committed to the realization of a sustainable society, in accordance with the Fuyo Lease Group Environmental Policy.

4. Fair Business Activities

-

(1)Fuyo Lease Group will always strive to deal honestly with its customers, and will make efforts to engage in transactions in compliance with established rules and procedures and under appropriate terms and conditions.

-

(2)Fuyo Lease Group will engage in fair and transparent transactions with all of its customers based upon the principle of free competition and in compliance with antitrust laws and other relevant laws.

-

(3)Fuyo Lease Group's directors, officers and employees will behave in a way that their own interests do not undermine the company's or its customers' interests, and will not use corporate assets for their own private purposes.

5. Risk Management

With full awareness of their respective roles and responsibilities, Fuyo Lease Group's operating divisions, corporate functions divisions and internal audit division will exercise appropriate management of and control over anticipated risks which Fuyo Lease Group may face in its activities.

6. Management of Information Assets and Respect for Intellectual Property Rights

-

(1)In recognition of the importance of information assets, Fuyo Lease Group will strictly manage such assets.

Fuyo Lease Group will obtain information from outside sources by legitimate means, and will not divulge to any other persons any personal and / or nonpublic information of its customers which may become known to it in the course of business or Fuyo Lease Group's own confidential information.

Any information which may be obtained by Fuyo Lease Group will be used solely for its business purposes, and not for insider trading or other private benefits. -

(2)Fuyo Lease Group will respect intellectual property rights including patent rights and copyrights, and will not infringe any other persons' intellectual property rights.

7. Appropriate Disclosure of Information

Fuyo Lease Group will continuously strive to improve transparency in the management of its business by fairly, timely and appropriately disclosing information.

8. Avoidance of Relations with Anti-Social Forces

-

(1)Fuyo Lease Group will avoid any relations with anti-social forces which threaten social order or safety.

-

(2)Fuyo Lease Group will not be involved in any way in terrorism, money laundering or any other organized crime.

9. Political Involvement; Government Relations

-

(1)The conduct of Fuyo Lease Group in political involvement and government relations will be sound and normal.

-

(2)Fuyo Lease Group will not be involved in any way in bribery or corruption.

Whistleblower Hotline

The Fuyo Lease Group has established and operates whistleblower hotlines.

In addition to the in-house compliance hotline, we provide a consultation service desk through a cooperating law firm. Guidance to these services is always posted on the company's intranet bulletin board so that concerned individuals can immediately seek consultation or make a report whenever they detect any violations of laws, regulations, the Fuyo Lease Group Basic Compliance Policy, and other corporate regulations, cases of any type of harassment, misconduct in information management, and other potential infringements. The whistleblower systems accept anonymous reports to protect whistleblowers.

Fuyo General Lease has appointed Compliance Managers* as consultants within their departments to handle individual cases. In the event of non-compliance or a suspected violation, Compliance Managers are responsible for taking appropriate measures and conducting investigations and reports in accordance with instructions and orders from the head of Fuyo Lease's Group Legal and Compliance Division. Additionally, in Group companies, management divisions or Compliance Managers appointed by each respective company play the same role.

-

*Compliance Manager: An individual responsible for promoting compliance appointed to each department to raise compliance awareness and ensure it is practiced.

Furthermore, Fuyo Lease has appointed full-time corporate auditors as a contact point for receiving whistleblower reports from group companies, and we have also set up a contact point at affiliated law firms for whistleblowing from employees of overseas subsidiaries.

In fiscal 2024, 17 reports were received through the hotline. In each case, we contacted the relevant parties to confirm the facts, conducted investigations promptly with due care to protect whistleblowers from detrimental treatment, and handled the cases appropriately by means such as seeking advice from lawyers.

All cases have been resolved, and measures put in place to prevent recurrences.

Prohibition of Corruption and Bribery

The implementation of fair and transparent transactions based on the principle of free competition is clearly stated in section 4. Fair Business Practices and Chapter 9, Relations with Politics and Governments of the Fuyo Lease Group Basic Compliance Policy. We prohibit corruption, including unfair or opaque transactions, insider trading, dealings with anti-social forces, money laundering, and bribery (including facilitation payments), and any actions that could be suspected of being corrupt are no exception. The Compliance Manual, which was established after deliberation by the Compliance Committee and introduced throughout the Group, ensures that all employees are familiar with and thoroughly understand these rules and regulations. The Management Committee and Board of Directors of Fuyo Lease oversee these policies and their management status and receive periodic reports from the Compliance Committee.

In order to prevent corruption and bribery and bring about its early detection, the Company implements compliance audits in addition to identifying businesses, intermediaries and business partners that are high risk in the flow of its operations and avoiding involvement with them. In business audits, risks regarding the identification and prevention of corruption and bribery are appropriately evaluated based on confirmation of items such as proper use of entertainment expenses and the existence of a long-term employees in the sales department.

We inform all Group employees about the Basic Compliance Policy and the prohibition of corruption and bribery, and encourage them to report to and seek consultation with the Whistleblower Hotline whenever they have any suspicions. This can be done anonymously.

Furthermore, the Basic Compliance Policy strictly prohibits the forging of collusive ties with political and administrative authorities and business partners, and the private use of the company's assets. In fiscal 2024, no infringements related to corruption were found in the Group. Additionally, no employees were dismissed or subjected to disciplinary action due to corruption.

In fiscal 2024, the Company made no political donations.

Compliance Training

The Fuyo Lease Group emphasizes employee training programs that are designed to ensure compliance.

Our training programs include workplace compliance training and e-learning on insider trading regulations for all Group employees (including dispatch and contract employees), as well as group training conducted by external instructors for directors, heads of departments, offices and branch offices, and presidents of Group companies.

Compliance Training (fiscal 2024)

Group training and workplace training

| Participant | Subject | # of session |

|---|---|---|

| New employees | Introduction to compliance, Fuyo Lease Group Basic Compliance Policy, exclusion of anti-social forces | 1 |

| 1st year employee (Generalist track) | Information security, harassment, prevention and insider regulations | 1 |

| Newly appointed heads of departments/branch offices | Required compliance understanding of managers | 1 |

| Newly appointed assistant manager / section chief | Prevention of power harassment, whistleblowing system | 2 |

| All employees (Including contract and dispatch employees and part-time workers) | Latent social media risks, care in handling personal information | 1 |

| Directors and head of department / office / branch office | Key considerations in information management illustrated by recent instances | 1 |

E-learning

| Participant | Subject | # of session |

|---|---|---|

| Directors, heads of departments/offices/branch offices, compliance managers, new employees | Regulation for Insider Trading (e-learning material of the Japan Exchange Group) | 2 |

| All employees (Including contract and dispatch employees and part-time workers) | General issues on compliance | 1 |

Prevention of Money Laundering

The Fuyo Lease Group is striving to prevent money laundering and funding of terrorism.

Fuyo Lease complies with laws and guidelines together with a thorough due diligence of its business partners in accordance with its Policy for the Prevention of Money Laundering. In addition, we have established a system to prevent money laundering and funding of terrorism not only in Japan but also in transactions outside Japan.

Prevention of Insider Trading

At the request of the Tokyo Stock Exchange, Fuyo Lease has joined the J-IRISS*, which aims to prevent unfair trading and to maintain the transparency and impartiality of the market.

-

*J-IRISS (Japan-Insider Registration & Identification Support System): A system operated by the Japan Securities Dealers Association by which listed companies register information on their officers and securities firms periodically compare this information on officers with their customer information with the aim of checking for unfair trading before it happens and eliminating it as much as possible.