Basic Approach to Corporate Governance

The Fuyo Lease Group places strong emphasis on creating and maintaining relationships with various stakeholders, including shareholders, customers, employees, and local communities. We believe that the fundamental and most important objective of corporate governance is to perform business activities with sincerity and fairness in line with the Group's mission, vision and value and to achieve the management targets outlined in the Group's Medium-Term Management Plan, Fuyo Shared Value 2026, for the years fiscal 2022 to fiscal 2026.

Corporate Governance Guidelines

In conformity with the purpose and spirit of the Japanese Corporate Governance Code, Fuyo Lease has established our own Corporate Governance Guidelines, which provide a foundation for corporate governance framework, operating policies, etc. The Corporate Governance Guidelines set out the framework, operating policies, roles, and responsibilities of different supervisory and executive functions, in addition to our basic approach to corporate governance. To achieve sustainable growth and increase our corporate value over the medium to long term, we adhere to these guidelines in everything we do across the Fuyo Lease Group.

For further details, please refer to: Corporate Governance Guidelines (PDF)

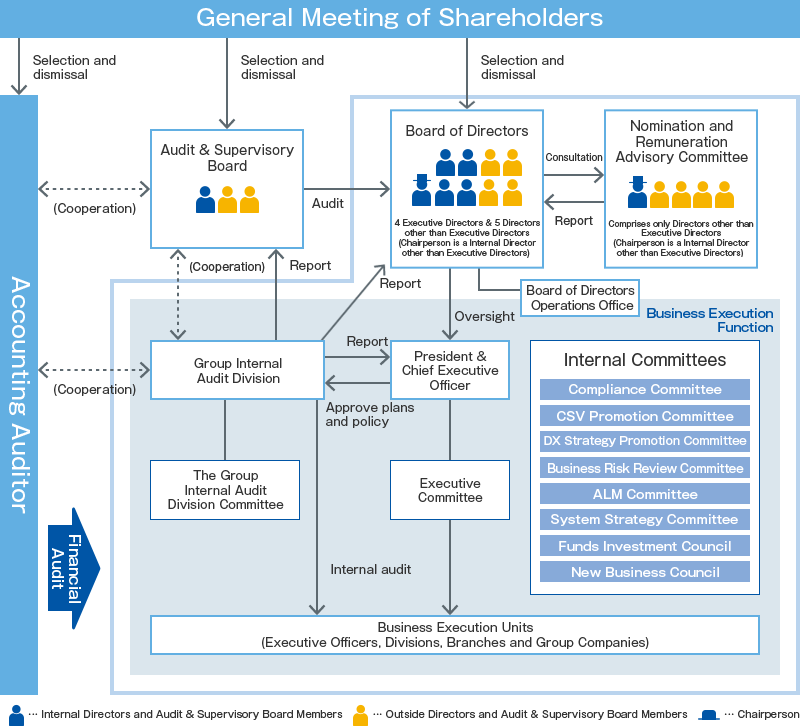

Corporate Governance Structure

Fuyo Lease employs the format of company with an Audit & Supervisory Board. It has two outside Audit & Supervisory Board Members, who are independent from the Company. In addition, to further improve the supervisory function of the Board of Directors, four independent outside directors are appointed to supervise and advise on the execution of business operations from an external perspective.

Furthermore, to improve management efficiency and expedite decision-making by separating the management oversight function from the execution of operations, we have adopted the executive officer system.

For further details, please refer to: Fuyo Lease Group Report on Corporate Governance (PDF)

Internal Committees

|

Compliance Committee |

The Compliance Committee discusses matters related to the promotion of compliance systems and the formulation of compliance programs (annual plan). |

|---|---|

|

CSV Promotion Committee |

The CSV Promotion Committee directs CSV promotion and deliberates on materiality planning, etc. |

|

DX Strategy Promotion Committee |

The DX Strategy Committee directs overall DX strategies and deliberates on the development of frameworks for the promotion of the strategies and necessary IT systems and the formulation of sales strategies. |

|

Business Risk Review Committee |

Business Risk Review Committee deliberates on projects that have a significant influence on management and policies for initiatives regarding business models and monitors the status of business risk, including credit risk. |

|

ALM Committee |

ALM Committee deliberates on specific measures for market risk management, including interest rates, foreign exchange and price fluctuations and monitors market risk situations. |

|

System Strategy Committee |

System Strategy Committee discusses and promotes overall strategies for the Company's IT systems. |

|

Funds Investment Council |

The Funds Investment Council deliberates on the establishment of investment limits regarding investment projects related to funds and monitors management status. |

|

New Business Council |

New Business Council deliberates on new projects that may generate new business fields. |

|

The Group Internal Audit Division Committee |

The Group Internal Audit Division Committee shares information, advises Group companies and promotes collaboration among the Group Internal Audit Divisions. |

Activities of Main Organizations

Board of Directors

The Board of Directors is chaired by a nonexecutive internal Director and at least one-third of the board members are Independent Outside Directors. Additionally, non-executive Directors make up at least half of the board, ensuring a separation between execution and oversight. The Board of Directors deliberates and decides on important matters such as management plans and risk management, as well as reporting on sustainability and CSV-related policies and progress, including non-financial targets (contributions to reducing CO₂, engagement indicators improvement rates, etc.) and progress with plans in each business domain, and supervising the Directors and Executive Officers in the execution of their duties.

In fiscal 2024, the Board of Directors met 11 times. The attendance rate was 99%(1 Director, 1 absence).

Nomination and Remuneration Advisory Committee

Fuyo Lease has set up the Nomination and Remuneration Advisory Committee as a voluntary advisory body of the Board of Directors to ensure objectivity and independence in the process of determining nomination of officers, remuneration, etc. The members and Chair of the Committee are non-Executive Directors. The Committee deliberates on the nomination of candidates for appointment as Directors or Audit & Supervisory Board Members or removal thereof, remuneration for Directors, succession plans for President & CEO, and the analysis and evaluation of overall effectiveness of the Board of Directors. The Committee then reports its findings to the Board of Directors. The content of such findings is determined based on the consent of all members present at the meeting, or when such consent may not be obtained, on the consent of a majority of the members present at the meeting.

In fiscal 2024, the Nomination and Remuneration Advisory Committee met 5 times. The attendance rate was 96%(1 committee member, 1 absence).

Audit & Supervisory Board

According to an audit plan prepared by the Audit & Supervisory Board, each Audit & Supervisory Board Member audits the execution of duties by Directors by attending important meetings, inspecting important documents, examining operations and assets and by hearing the audit findings of the Group Internal Audit Division. Audit & Supervisory Board Members work closely with the Group Internal Audit Division and internal control departments to enhance audit quality. At the request of an Audit & Supervisory Board Member, an employee (a staff member from the Board of Directors Operations Office) has been appointed to assist them.

In fiscal 2024, the Audit & Supervisory Board met 14 times. The attendance rate was 100%.

Attendance at Board and Committee meetings (attendance in FY 2024 by board members, as of June 24, 2025)

| Name | Position | Attendance at Board and Committee meetings |

|---|---|---|

| Yasunori Tsujita | Director and Chairman Chairperson of the Board of Directors |

Board of Directors: 11/11 |

| Chairperson of the Nomination and Remuneration Advisory Committee | Nomination and Remuneration Advisory Committee: 5/5 | |

| Hiroaki Oda | President and Chief Executive Officer (Representative Director) | Board of Directors: 11/11 |

| Keiji Takada | Director and Deputy President (Representative Director) | Board of Directors: 11/11 |

| Yusuke Kishida | Director and Deputy President (Representative Director) | Board of Directors: 11/11 |

| Hiroshi Takahashi | Managing Director | Board of Directors:9/9 (Elected in June 21,2024) |

| Hideo Ichikawa | Director (Independent Outside Director) | Board of Directors: 11/11 |

| Member of the Nomination and Remuneration Advisory Committee | Nomination and Remuneration Advisory Committee: 5/5 | |

| Masayuki Yamamura | Director (Independent Outside Director) | Board of Directors: 11/11 |

| Member of the Nomination and Remuneration Advisory Committee | Nomination and Remuneration Advisory Committee: 5/5 | |

| Hiroko Matsumoto | Director (Independent Outside Director) | Board of Directors: 10/11 |

| Member of the Nomination and Remuneration Advisory Committee | Nomination and Remuneration Advisory Committee: 4/5 | |

| Kazuya Masu | Director (Independent Outside Director) Member of the Nomination and Remuneration Advisory Committee |

Elected in June 24,2025 |

| Masato Morikawa | Full-time Audit & Supervisory Board Member | Board of Directors:9/9 Audit &Supervisory Board:10/10 (Elected in June 21,2024) |

| Tomohiko Okazaki | Full-time Audit & Supervisory Board Member | Elected in June 24,2025 |

| Hiroshi Imoto | Outside Audit & Supervisory Board Member (Independent) | Board of Directors: 11/11 Audit & Supervisory Board: 14/14 |

| Eimei Ookubo | Outside Audit & Supervisory Board Member (Independent) | Elected in June 24,2025 |

Executive Committee

The Executive Committee is composed of Executive Officers with positions of Managing Executive Officer or higher, the heads of the Corporate Planning Division and Human Resources Division as well as the presidents of affiliated companies. Full-time Audit & Supervisory Board Members also attend meetings of the Committee on a regular basis.

As a general rule, the Executive Committee meets at least once a month to make decisions on operating activities and implementation of measures delegated to the President & CEO, and to discuss important issues concerning internal controls. Its aim is to improve the quality of management decisions and to speed up decision-making.

In fiscal 2024, the Executive Committee met 20 times.

Compliance Committee

Fuyo Lease has set up a Compliance Committee chaired by the Chief Compliance Officer and vice chaired by the Group Legal and Compliance Division Officer. The heads of relevant corporate departments, the heads of relevant departments of domestic and overseas subsidiaries serve as full-time committee members, and outside lawyers serve as outside members. Furthermore, the committee is also attended by observers, including the full-time Audit & Supervisory Board Members and the presidents of domestic subsidiaries. The Compliance Committee meets quarterly to deliberate and discuss matters related to compliance systems and implementing annual compliance plans. The matters deliberated and discussed by the Committee are reported to the Board of Directors and the Executive Committee, and measures are taken to develop and enhance compliance systems.

Internal Audit

The internal audit function is administered by the Group Internal Audit Division (staffed by 11 employees). The Group Internal Audit Division conducts operational audits of all departments, offices, branch offices, and major subsidiaries, and plays a part in ensuring that internal controls are functioning in addition to examining their effectiveness. The results of these audits of operations are reported directly to the President & CEO and Audit & Supervisory Board Members by the general manager of the Group Internal Audit Division every time they are conducted and reported directly regularly twice a year to the Board of Directors, the Audit & Supervisory Board, and the Executive Committee.

Internal Control System

Fuyo Lease has instituted an internal control system across our corporate group to ensure compliance with all relevant laws and the articles of incorporation, capability to respond to various risks in a timely and appropriate manner, and to ensure transparency and efficiency of operations, in addition to ensuring the reliability of financial reports, etc.

The Group Internal Audit Division, Audit & Supervisory Board Members, and accounting auditor share information about audit findings to monitor the status and operation of the internal control system. The status of the internal control system operation is reported to the Board of Directors during a meeting held at the end of each fiscal year, and continuous improvements are made in the light of the audit findings.

Initiatives to Improve the Effectiveness of the Board of Directors

Fuyo Lease is engaged in a number of initiatives to ensure active and substantial discussions at its Board of Directors' meetings. Regarding the analysis and evaluation of the overall effectiveness of the Board of Directors, a questionnaire was administered to all directors and Audit & Supervisory Board Members and interviews were held as necessary. After deliberations and reporting by the Nomination and Remuneration Advisory Committee (with the committee's secretariat being assisted by our corporate lawyers), of which independent outside directors comprise the majority, the results of the analysis and evaluation were resolved by the Board of Directors.

Evaluation process

Assessment Criteria

-

1.Composition, etc. of the Board of Directors

-

2.Oversight and execution by the Board of Directors

-

3.Operation of the Board of Directors

-

4.Frameworks for supporting Outside Officers

-

5.Summary

FY2024 Evaluation Results

The effectiveness of the Board of Directors was confirmed as its size, composition, functions, roles, operation, and all other evaluation items were recognized to be appropriate. It is necessary to continue to steadily promote and further establish measures to improve the functions of the Board of Directors and to constantly review the Board of Directors in response to changes in the internal and external environment.

Progress on Issues identified last fiscal year

- Issue 1 Further improvement of the Board of Directors' functions

-

FY2024 Initiatives

-

Reviewed content of management reports to more clearly depict the external environment (macroeconomic trends), circumstances in each business domain of the Group, and signs of changes thereof

-

Promoted meeting management guidance by the Chairperson in a manner that seeks to stimulate discussion among the Board of Directors

-

- Issue 2 Steady progression was made on the Medium-Term Management Plan and further deepening of CSV management

-

FY2024 Initiatives

-

With the current medium-term management plan having reached its midpoint, the plan was revised based on discussions held in a forum separate from the Board of Directors and involving both internal and external officers. The discussions involved review of strategies and initiatives for the latter half of the plan, considering changes in the external environment and progress achieved under plans of each business domain.

-

Steadily promoted the medium-term management plan and greater depth of CSV management, including reporting on the human resources portfolio and employee engagement, as well as reporting on the development and progress of the Group BCP (business continuity plan)

-

- Issue 3 Further enhanced information provision to Outside Officers

-

FY2024 Initiatives

-

Further enhanced and expedited the provision of information to Outside Officers by accelerating the presentation of materials associated with preliminary briefings for Outside Officers

-

Future Issues and Initiatives

We managed to achieve a certain level of improvement by implementing specific measures to address issues identified in the previous fiscal years. Building on results of such efforts, we aim to further improve effectiveness of the Board of Directors by continuing to address issues identified in the previous fiscal year in the coming fiscal years. This will involve enhancing Board of Directors membership composition and diversity as well as achieving greater depth of Group management looking toward the next medium-term management plan, in addition to improving functions of the Board of Directors through reporting on matters such as the governance structure and risk management system on a Groupwide basis, as well as achieving more substantive discussions on business portfolio and business domain strategies from a medium- to long-term perspective, and further enhancing training opportunities provided to Outside Directors.

Support for Outside Directors

The Company is taking steps to establish a support framework, which includes providing Outside Directors with information necessary for carrying out duties that include management oversight and audits. Specifically, this will involve providing Outside Directors with various forms of support, such that includes sending agendas for Board of Directors and Audit & Supervisory Board meetings in advance, offering pre-meeting briefings on items to be submitted to the Board of Directors, providing materials and minutes from Executive Committee meetings, offering opportunities to observe meetings of heads of departments, offices and branch offices, organizing onsite inspections, and facilitating opportunities to attend external seminars. Three staff members have been assigned to the Board of Directors Operations Office to manage these secretariat functions for the Outside Directors. Going forward, we will continue to provide support, incorporating the requests and opinions of our Outside Directors, to facilitate more substantive discussions.

Strengthening Corporate Governance

Fuyo Lease has implemented various initiatives aimed at strengthening corporate governance.

Initiatives from 2015 onwards are as shown below.

| Year | Initiative | Objective |

|---|---|---|

| 2015 | Increased the number of independent outside directors from one to two | To strengthen the management oversight structure |

| Established the Corporate Governance Guidelines | To comply with the Japanese Corporate Governance Code | |

| Set up the Nomination and Remuneration Advisory Committee | To ensure independence and objectivity in the decision-making process for matters such as nomination and remuneration | |

| 2016 | Started analyzing and evaluating the overall effectiveness of the Board of Directors | To verify the effectiveness of the roles and functions, etc. of the Board of Directors and to make ongoing improvements |

| 2018 | Increased the number of independent outside directors from two to three | To strengthen the management oversight structure |

| Introduced a stock remuneration plan (Board Benefit Trust, BBT) | To strengthen links between board remuneration, shareholder value, and achievement status of the Medium-term Management Plan | |

| 2019 | Released an English version of the Corporate Governance Report | To enhance external disclosure related to corporate governance |

| Began reporting annual internal audit results and annual plans and policies to the Board of Directors | To expand reporting lines for internal audits | |

| 2021 | Increased the number of independent outside directors from three to four | To strengthen the management oversight structure |

| Revised Corporate Governance Guidelines | To comply with revised Japanese Corporate Governance Code | |

| 2022 | Appointed a non-executive Director as chairperson of the Board of Directors | Separation of execution and supervision |

| Comprised the Nomination and Remuneration Advisory Committee of non-executive Directors | ||

| Regarding indicators used for the calculation of performance-linked remuneration based on the new medium-term management plan, changes were made to financial items and non-financial items were added. | To ensure the achievement of financial and non-financial targets in the new medium-term management plan |

Director Qualifications and Nomination Procedures

Policy and procedures for nominating and removing Directors and nominating candidates for Audit & Supervisory Board Member

Our Corporate Governance Guidelines set forth procedures for nominating and removing Directors in addition to the qualifications of Audit & Supervisory Board Members and procedures for nominating Audit & Supervisory Board Member candidates. Under these guidelines, a Director or Audit & Supervisory Board Member candidate must possess an outstanding character, a wide breadth of knowledge, abilities, experience, and high ethical standards. The guidelines also specify that candidates be nominated regardless of factors such as sex, age, and nationality, with the aim of achieving greater diversity. To ensure fairness and transparency in the nomination process, the selection of candidates for Directors and Audit & Supervisory Board Members is finalized by the Board of Directors following a discussion by the Nomination and Remuneration Advisory Committee, which is comprised of majority Independent Outside Directors. Selection of Audit & Supervisory Board Member candidates is finalized by the Board of Directors upon consent of the Audit & Supervisory Board.

Independence standards for Outside Directors and Outside Audit & Supervisory Board Members

Independence standards for Outside Directors and Outside Audit & Supervisory Board Members are stipulated in the Corporate Governance Guidelines in line with the independence standards prescribed in the Guidelines Concerning Listing Management, etc. established by the Tokyo Stock Exchange.

Skills Matrix

The chart below shows the areas where each Director and Audit & Supervisory Board Member is particularly expected to contribute significantly. This takes into account their expertise and experience, etc., to steadily implement and achieve the goals of the MediumTerm Management Plan.

As of June 24,2025

![[Director] Yasunori Tsujita | Status of business execution, etc.: Chairman of the Board of Directors/Chairman of the Board of Directors/Nomination and Compensation Advisory Committee: Chairman/Years of office: 10 years/Areas of particular expectation: Corporate management (industry) (finance (banking and leasing)), IT and technology, human resource development, and internal control and management, Hiroaki Oda | Status of business execution, etc.: President (Representative Director)/President Executive Officer/Nomination and Compensation Advisory Committee: None/Years of office: 4 years/Areas of particular expectation: Corporate management (industry) (finance (banking and leasing)) and global business, Keiji Takada | Status of business execution, etc.: Vice President (Representative Director)/Vice President Executive Officer/Nomination and Compensation Advisory Committee: None/Years of office: 5 years/Areas of particular expectation: Corporate management (industry) (finance (leasing)) and global business, Yusuke Kishida | Status and other business execution status: Director, Vice President (Representative Director) / Vice President Executive Officer / Nomination and Compensation Advisory Committee: None / Years of office: 3 years / Areas of particular expectation: Business management (industry) (finance (leasing)), financial accounting, and internal control and management, Hiroshi Takahashi | Status and other business execution status: Managing Director / Managing Executive Officer / Nomination and Compensation Advisory Committee: None / Years of office: 1 years / Areas of particular expectation: Business management (industry) (finance (leasing)), financial accounting, and internal control and management, Hideo Ichikawa | Status of work execution, etc.: Director (outside/independent) / Nomination and Compensation Advisory Committee: Member / Years of office: 7 years / Areas of particular expectation: Corporate management (industry) (chemicals/manufacturing), global business, human resource development, and internal control/management, Masayuki Yamamura | Status of work execution, etc.: Director (outside/independent) / Nomination and Compensation Advisory Committee: Member / Years of office: 6 years / Areas of particular expectation: Corporate management (industry) (communications/technology), finance/accounting, IT/technology, and internal control/management, Hiroko Matsumoto | Status of work execution, etc.: Director (outside/independent)/Nomination and Remuneration Advisory Committee: Member/Years of office: 4 years/Areas of particular expectation: Business management (university education, industry-government-academia collaboration, product design) and human resource development, Kazuya Masu | Status of work execution, etc.: Director (outside/independent)/Nomination and Remuneration Advisory Committee: Member/Years of office: New election/Areas of particular expectation: Business management (university education, technical business development) , global business, IT/technology, and human resource development, [Auditor] Masato Morikawa | Status of work execution, etc.: Full-time Audit & Supervisory Board Member/Nomination and Remuneration Advisory Committee: None/Years of office: 7 years /Areas of particular expectation: Business management (industry), finance (leasing), financial/accounting, and global business, Tomohiko Okazaki | Status of work execution, etc.: Full-time Audit & Supervisory Board Member/Nomination and Remuneration Advisory Committee: None/Years of office:New election /Areas of particular expectation: Business management (industry), finance (leasing) and Internal control and management, Hiroshi Imoto | Status of work execution, etc.: Audit & Supervisory Board Member (outside/independent)/Nomination and Remuneration Advisory Committee: None/Years of office: 4 years /Areas of particular expectation: Business management (industry), finance (international finance), global business, Human resources development, and Internal control and management, Eimi Ookubo | Status of duties: Audit & Supervisory Board Member (outside/independent) / Nomination and Remuneration Advisory Committee: None / Years of office: New election / Areas of particular expectation: Business management (industry), finance (insurance) and finance/according.](/eng/sustainability/corporate/images/governance-img-04.png)

-

(Note)

-

1.The above table does not show all the insight and experience held by each Director and Audit & Supervisory Board Member.

-

2.Of the 13 Directors and Audit & Supervisory Board Members, 12 are male and 1 is female. Years in office are calculated based on the number of months.

Director Remuneration

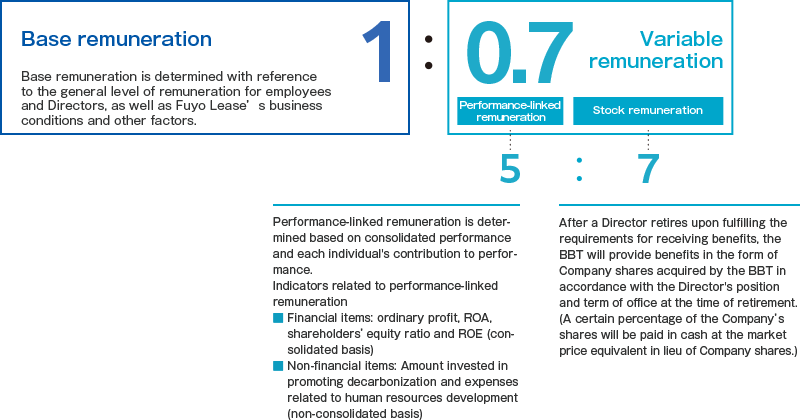

Fuyo Lease has a basic policy to link Director remuneration to corporate performance and shareholder value to boost their morale and motivate them to improve the Company's financial performance and share price, ensuring stable performance and growth, while enhancing corporate value.

Regarding determination of remuneration for individual Directors, the basic policy is to set it at an appropriate level, taking into account each Director's respective responsibilities and other factors. The Company has introduced performance-linked remuneration and stock-based remuneration (Board Benefit Trust (BBT)) as variable remuneration systems, in addition to base remuneration provided as fixed remuneration.

The amount of performance-linked remuneration is determined based on factors such as consolidated performance, degree of contribution to Company performance and efforts to address medium- to long-term management issues. Performance linked remuneration is determined according to consolidated business performance and contribution made by each officer to the performance. The stock remuneration plan is designed to further clarify the link between officers' remuneration and the value of the Company's shares and to further raise officers' awareness of contributing to improving business performance and increasing corporate value over the medium to long term.

Taking into consideration the average ratio of remuneration in listed companies and other factors, the ratio of remuneration and the breakdown of variable remuneration are as shown in the chart below.

Directors' remuneration is discussed by the Nomination and Remuneration Advisory Committee to ensure greater transparency and objectivity.

Internal Directors who do not execute operations are paid fixed remuneration and stock based remuneration, while Audit & Supervisory Board Members and Outside Directors who have supervisory functions are paid fixed remuneration only because the concept of performance based remuneration and stock remuneration is not suitable for the nature of their duties.

Fuyo Lease stipulates in its internal rules that if a Director causes significant damage to the Company or engages in inappropriate conduct, etc., the Director will be subject to a reduction or non-payment of their base remuneration or performance-based remuneration, or cancelation of their right to receive stock remuneration.

Internal Director Remuneration Composition

Remuneration of Board Member (Fiscal 2024)

| Board Member classification | Total amount (millions of yen) | Breakdown of remunerations (millions of yen) | Number of Board Member Applicable | ||

|---|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration | Non-monetary remuneration | |||

| Directors | 382 | 244 | 56 | 81 | 10 |

| (Outside Directors) | 52 | 52 | - | - | 4 |

| Audit & Supervisory Board Members | 63 | 63 | - | - | 5 |

| (Outside Audit & Supervisory Board Members) | 24 | 24 | - | - | 2 |

-

*Performance-linked compensation is the amount that should be recorded as expenses in fiscal 2024.

-

*Non-monetary compensation is a Board Benefit Trust (BBT). The amount of the BBT is the amount that should be recorded for the fiscal year under review based on the number of points granted or expected to be granted during the fiscal year.