| Name | Fuyo General Lease Co., Ltd. No.27 unsecured corporate bonds (limited to corporate bonds with a special agreement on the same priority) (Sustainability-Linked Bond) |

|---|---|

| Issue duration | 7 years |

| Issuance amount | 10 billion yen |

| Issuing Conditions and Related Sustainability Performance Targets (SPTs) |

|

| Coupon rate | 0.380% per annum from the day following December 24, 2020 to December 24, 2024. From the day following December 24, 2024, a coupon step-up of 0.10% will be generated if any of the SPTs linked to the issue conditions have not been met on July 31, 2024. |

| Condition decision date | December 18, 2020 |

| Issue date | December 24, 2020 |

| Redemption date | December 24, 2027 |

| Ratings | Japan Credit Rating Agency, Ltd. (JCR): A+ Rating and Investment Information, Inc. (R&I): A |

Third-party Assessment of Eligibility

Ministry of the Environment's Model Case for Issuance

The Fuyo Lease Group's Sustainability-Linked Bond was selected as a model case for the fiscal 2020 Sustainability Linked Loans, etc. Issuance by the Ministry of the Environment, and on November 27th, 2020 it was announced that the Ministry of the Environment and certification bodies (Japan Credit Rating Agency, Ltd. and E&E Solutions Inc.) had verified the conformity of the framework for issuing of the Sustainability Linked Bond with the Ministry of the Environment's Green Loan and Sustainability Linked Loan Guidelines 2020 and the International Capital Markets Association's (ICMA) Sustainability-Linked Bond Principles.

Announcement of Investment in the Sustainability-Linked Bond

These are the investors who have announced that they will invest in the Sustainability-Linked Bond

List of investors who have announced investment (Japanese alphabetic order)

(As of December 18, 2020)

-

IO Shinkin Bank

-

AICHI CHITA AGRICULTURAL COOPERATIVE ASSOCIATION

-

Asset Management One Co., Ltd.

-

Awaji Shinkin Bank

-

Ishinomaki Shinkin Bank

-

Ibaraki Prefectural Credit Federation of Agricultural Cooperatives

-

Okayama Shinkin Bank

-

THE KANAGAWA BANK, LTD.

-

Kanonji Shinkin Bank

-

Gifu Prefectural Credit Federation of Agricultural Cooperatives

-

Kuwanamie Shinkin Bank

-

The 77 Bank, Ltd.

-

Shinonome Shinkin Bank

-

Shibata Shinkin Bank

-

Suwa Shinkin Bank

-

Seishin Shinkin Bank

-

Saison Automobile and Fire Insurance Co., Ltd.

-

Takanabe Shinkin Bank

-

Tajima Shinkin Bank

-

Danyo Shinyo Kumiai Bank

-

Choshi Shinkin Bank

-

Tokyo City Shinkin Bank

-

Tokyo Higashi Shinkin Bank

-

The Tono Shinkin Bank

-

The Toa Reinsurance Company, Limited

-

The Toyota Shinkin Bank

-

Nagano Shinkin Bank

-

Nagano Labour Bank

-

Nagoya Broadcasting Network Co., Ltd.

-

Nishihyogo Shinkin Bank

-

Nishimikawa Agricultural Cooperative

-

Nissay Asset Management Corporation

-

Hagi Yamaguchi Shinkin Bank

-

Handa Shinkin Bank

-

Hanno-Shinkin Bank

-

Hyogo Shinkin Bank

-

Hiratsuka Shinkin Bank

-

Fukoku Mutual Life Insurance Company

-

BlackRock Japan Co., Ltd.

-

The Hekikai Shinkin Bank

-

Mie Prefectural Credit Federation of Agricultural Cooperatives

-

The Miyazaki Taiyo Bank, Ltd.

-

Moka Credit Union

-

The Yuki Shinkin Bank

-

Yokohama Agricultural Cooperative

-

Lifenet Insurance Company

-

Wakayama Prefectural Credit Federation of Agricultural Cooperatives

Reporting

SPTs and Status of Progress on Targets

SPT 1 Renewable energy usage rate for group electricity consumption 50% or more (Maturity: July 2024)

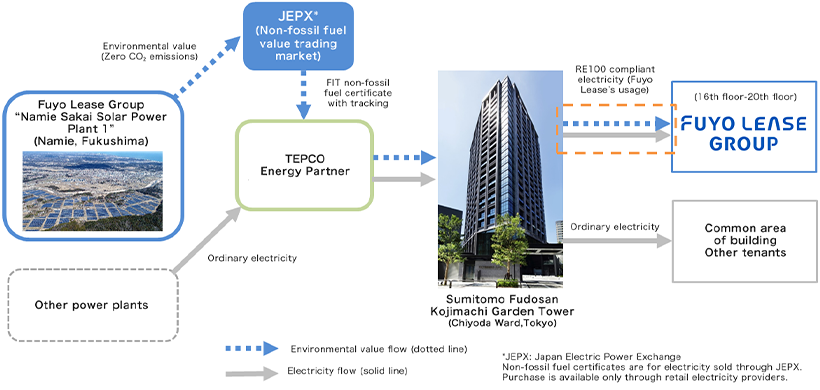

In participating in RE100, Fuyo General Lease has set a target of 50% renewable energy use for the Group by 2030 and 100% by 2050. However, under SPT (1) for this sustainability linked bond, we have brought forward the medium-term target achievement timing to renewable energy use of 50% by July 2024.*1 Most of the Fuyo Lease Group's electricity consumption takes place among tenants of its office buildings. The Company is cooperating with the building owner of its head office building and with retail electricity providers to develop a new method for realizing effective transition to renewable energy for tenants.*2 In fiscal 2021, the Group's head office switched to being powered by renewable energies. Since fiscal 2022, multiple business sites in Japan have been promoting the conversion to renewable energies and in fiscal 2023, we procured non-fossil fuel certificates. As a result, we have achieved our target. Going forward, we will continue to work to achieve our RE100 targets by switching to renewable energy at various business sites.

Status of Progress

Renewable energy usage rate for group electricity consumption: 84.6% (as of June 30, 2024) <Achieved target>

-

*1In July 2021, we brought the target forward again, so that the current target is "50% by 2024, 100% by 2030."

-

*2Relevant press release:"Individual Office Building Tenants Switch to RE100 Compliant Electricity from Solar Power Station at Namie, Fukushima Prefecture, which is Working to Recover from the Great East Japan Earthquake" (In Japanese only)

SPT 2 Cumulative amount of the Fuyo 100% Renewable Electricity Declaration Support Program, and the Fuyo Zero Carbon City Support Program 5 billion yen or higher (Maturity: July 2024)

The second SPT is a target for the cumulative handling amount of the Fuyo 100% Renewable Electricity Declaration Support Program, and theFuyo Zero Carbon City Support Program of 5 billion yen or higher by 2024. The Fuyo Zero Carbon City Support Program uses green bonds and other sources of funds raised by the Company to provide financial support to customers who are introducing properties that contribute to renewable energy and energy conservation. To date, it has been used by customers representing more than 300 organizations located in 36 prefectures throughout Japan. As of September 30, 2023, the handling amount for both programs reached a cumulative total of 16.03 billion yen, achieving the target ahead of schedule. Under the Medium-Term Management Plan Fuyo Shared Value 2026, which started in fiscal 2022, we are aiming for a cumulative handling amount for both programs of 15 billion yen (fiscal 2022 to fiscal 2026) as one of our non-financial targets. We will continue to advance both programs to actively support companies and local governments that are engaged in decarbonization.

![ESG Investors→Green Bonds→[Fuyo 100% Renewable Electricity Declaration Support Program]→①Major corporations②Small and mediumsized companies and organizations③Companies and organizations in the area of zero-carbon cities ESG Investors→Green Bonds→[Fuyo Zero Carbon City Support Program]→Donate a portion of lease contract value (Foundations, incorporated associations,NPOs,etc.) or①Major corporations②Small and mediumsized companies and organizations③Companies and organizations in the area of zero-carbon cities](/eng/sustainability/esg/linkedbond/images/data01-img-02.png)

Status of Progress

Cumulative amount: 29.79 billion yen (as of July 31, 2024) <Achieved target>