AT: Accelerating Transformation

Accelerated growth enabled by capturing market trends

*Affiliations and titles as of August 2025

*Affiliations and titles as of August 2025

Main Services

-

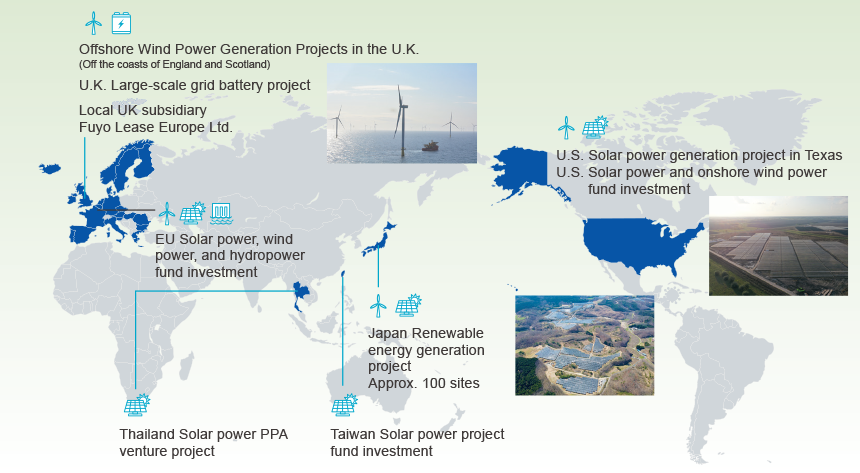

Investment and finance in energy businesses

-

Green electricity supply (PPA) services

-

Energy-saving equipment / subsidy leases

-

ESCO business

-

Storage battery business

Strong Point

-

Extensive experience gained through participation in investment and project finance for domestic and overseas renewable energy and storage battery businesses

-

Collaboration with diverse alliance partners in energy-saving, renewable energy and energy storage projects supporting customers' decarbonization

Plans under Fuyo Shared Value 2026 and Vision for 2030

Vision for 2030

-

Serve as a global company that helps give rise to a decarbonized society by engaging in a broad range of energy-related businesses on a large scale in Japan and overseas

-

Serve as a frontrunner that contributes to resolving climate change and other environmental issues in breaking ground in the new Energy & Environment business domain

Plans under Fuyo Shared Value 2026

-

1.Aim to invest a cumulative total of ¥300.0 billion over the 5 years through fiscal 2026 to promote decarbonization

-

2.Increase the supply of renewable energy, targeting 1,000 MW of renewable energy power generation capacity

-

3.Take on the challenge of developing new businesses set to emerge and grow as a result of structural transformation in the energy industry, such as the grid storage battery business

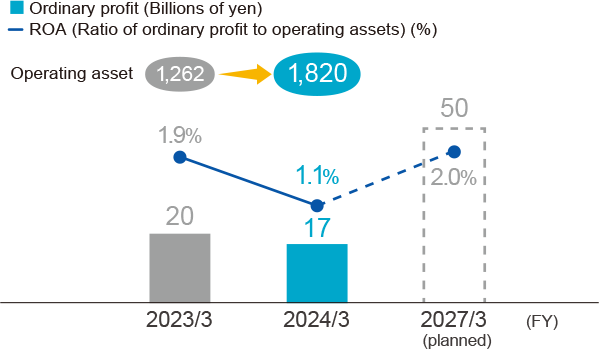

Fuyo Shared Value 2026 First Half Results

-

Assets increased due to proactive investment in overseas renewable energy businesses, mainly in Europe and the US On the other hand, profit contributions were limited due to rising procurement costs

-

GLOBAL ENGINEERING, which engages in multifaceted electric power services business including power supplydemand adjustment business, became an equity-method affiliate. This has enabled us to reinforce our functions for further business expansion

Fiscal 2024 Results

-

Accumulation of operating assets progressed, mainly in overseas renewable energy projects

-

Although foreign currency funding yields passed their peak, ordinary profit remained on par with the previous year

Financial targets

Non-financial targets

Figures in brackets for renewable energy power generation capacity include projects under development

-

*1Applies to investments and project financing, etc., made in the Renewable Energy Generation Business (power generation capacity is calculated based on ownership ratio or share)

Issues Ahead and Response Measures

|

Issues Ahead |

Response Measures |

|---|---|

|

Strengthen our operating base to promote global business expansion |

Strengthen collaboration with overseas sites, mainly the local UK subsidiary, and increase alliance partner companies |

|

Develop skilled professionals with insights into the energy & environment industry and overseas fields |

Dispatch personnel to partner companies and develop human resources through education and training programs |

TOPICS

1. Business Expansion Through Partnerships with Global Players

Since the 2013 launch of our solar power project in Japan, we have participated in overseas projects including solar power in the United States as well as offshore wind power, onshore wind power, and solar power projects in Europe, where investment opportunities are abundant.

In 2023, we established a local subsidiary in London with the aims of facilitating collaboration between foreign enterprises and Japanese companies engaged in the renewable energy business in Europe and of enhancing information gathering in upstream areas. We promote uptake of renewable energy in Japan and overseas by expanding business through partnerships with global players.

2. End-to-End Business Development in the Electricity Market

Fuyo Lease Group participated early in the grid storage battery project, a new business model essential for stabilizing utility grids and making renewable energy the main source of power.

Furthermore, as the first leasing company to establish a strategic capital and business alliance with an energy management company, we promote the adoption of distributed power sources centered on grid storage batteries, beyond standalone renewable power generation. Through this end-to-end business approach in the electricity market, we contribute to achievement of carbon neutrality and promotion of green transformation (GX).

Site of grid storage battery project (Sapporo, Hokkaido)

Site of grid storage battery project (Sapporo, Hokkaido)