GP: Growing Performance

Stable growth in core areas

*Affiliations and titles as of August 2025

*Affiliations and titles as of August 2025

Main Services

-

Aircraft operating leases/financing

-

Japanese Operating Lease with Call Option* (JOLCO)

-

Japanese Operating Lease (JOL)

-

Aircraft fleet management and resale

-

Business investment (investment in peripheral business)

-

*Fuyo General Lease Co. Ltd. arranges JOLCOs as a business activity, thereby providing its investor clients with the option to invest their funds in such aircraft leases.

Strong Point

-

Established an extensive track record through arrangement of more than 350 leases for airlines around the world since the launch of our aircraft business in the early days of the aircraft leasing industry

-

Possesses aircraft operating lease arrangement and solutions delivery capabilities, developed through hands-on business experience

-

Embraces a culture that encourages members to confront customer management issues and societal challenges, as well as actively participate in new domains, while keeping aircraft operating leases as a base

Plans under Fuyo Shared Value 2026 and Vision for 2030

Vision for 2030

-

Create synergies by expanding our product lineup through alliances in peripheral aircraft businesses, while keeping aircraft operating leases as the core of our business

-

Contribute to the development of the aviation industry and the establishment of global transportation and logistics infrastructure, while helping to solve environmental and social issues, through new areas and technologies

Plans under Fuyo Shared Value 2026

-

1.Advance an asset turnover-type business that maintains the soundness of self-owned assets by realizing a balance between stable recurring revenue and non-recurring revenue from asset sales.

-

2.Strive to further strengthen sales capabilities to investors through efforts to develop and sell new operating lease products, in addition to JOLCO and JOL.

-

3.Strengthen engagement in peripheral fields and new areas, such as aircraft part-out and freighter conversion in accordance with the aircraft lifecycle

Fuyo Shared Value 2026 First Half Results

-

Accumulation of the Company’s fleet of self-owned aircraft proceeded at a level exceeding initial assumptions as a result of tapping into robust aircraft demand from airlines accompanying recovery of passenger traffic

-

Achieved the ordinary profit target for the final fiscal year of the initial medium-term management plan ahead of schedule due to factors that include accumulation of self-owned aircraft, progress in making lease fee collections from irregular clients, and ongoing yen depreciation

Fiscal 2024 Results

-

Arranged a JOLCO with a sustainability-linked loan for Turkish Airlines Inc. This marked the first time Turkish Airlines raised funds using sustainable finance

-

Concluded an operating lease agreement for a car carrier vessel with the Mitsui O.S.K. Lines Group, with the Company acting as an enabler (an enabler is an investment and financing entity that facilitates transition to decarbonization of other entities)

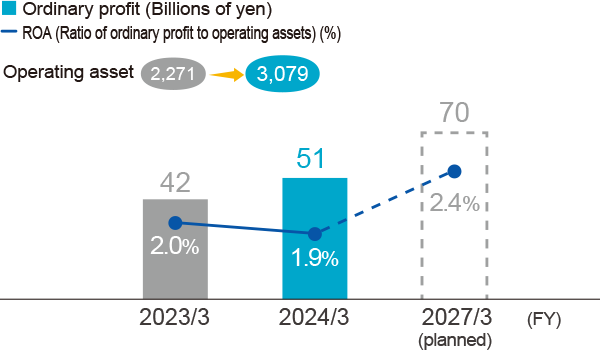

Financial targets

Issues Ahead and Response Measures

|

Issues Ahead |

Response Measures |

|---|---|

|

Respond to rising interest in environmental issues in the aviation industry |

Accelerate environmentally friendly initiatives, such as leases with Sustainability Linked Loans (SLLs) |

|

Enhance specialized human resources supporting business expansion and development of new business fields |

Promote the recruitment and training of globally minded human resources with a degree of high specialization |

TOPICS

1. Freighter Aircraft Lease Begun for Yamato Holdings

The Company began a freighter aircraft lease for YAMATO HOLDINGS CO., LTD. This initiative allows for long-term aircraft reuse, on the one hand, by converting used passenger aircraft into freighter aircraft. At the same time, it will contribute to addressing the so-called 2024 problem with its concerns about declining transport capabilities in the logistics industry. This is the Company's first Passenger-to-Freighter (P2F) project, and through this business we will contribute to CSV in the aircraft market while also aiding in the further growth of the logistics industry.

Photo courtesy of YAMATO HOLDINGS CO., LTD.

Photo courtesy of YAMATO HOLDINGS CO., LTD.